Mobile Check Deposit Bank Of America

Transfers require enrollment in the service and must be made from an eligible Bank of America consumer or business deposit account to a domestic bank account or consumer debit card. Recipients have 14 days to enroll to receive money or the transfer will be canceled. Mobile check deposit provides you a secure and convenient option right from your home! Important Information: Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (BofA Corp.). The Bank of America iPhone app has a feature that allows you to deposit your checks right from your phone. Use this article to find out how to deposit a check from your phone, and you won't have to travel to the bank ever again. How can I deposit my paper check without visiting a Financial Center? Download our Mobile Banking app. In the app, you can deposit a paper check, using a photo image, and get confirmation immediately that your deposit has been received. Go to our ATM and Financial Center locator to find nearby ATMs that accept deposits. Maybe you want to deposit checks too large for Bank of America’s mobile app deposit limits (where you deposit checks by taking a photo). You have a few options: Call Bank of America at 800-432-1000 and order some in the mail: time needed: days.

If you bank at Bank of America, never make an ATM deposit there, especially if the money’s coming from another bank. Here’s why…

I’m a Bank of America account-holder, which is to say I’ve also been a Bank of America hostage.

For the last week, Bank of America has held a $2,080 deposit of mine — written by my business partner off her account with another bank — as “delayed.” For a week. For seven days, Bank of America customer service agents either wouldn’t or couldn’t explain why I could not access money that was properly deposited and is MY money.

Until last night.

After I raised a stink on social media (which is a #WiseStrategy you should read about here), a very professional BofA social media agent reached out. She explained to me that because I deposited the check via an ATM inside my neighborhood Bank of America branch and because the check was an unusual amount ($2,080? Not exactly a fortune) written from another bank’s account, it triggered a 7-day delay in making the funds available.

Well, that triggered me — not only because my own bank was holding my money hostage, but also because my bank may have violated federal law.

According to BankRate.com, federal regulations require that local funds deposited via an ATM must be made available no later than the second business day after the deposit, as long as the check was deposited on a banking day (mine was a non-holiday Monday), and the check was deposited in an ATM owned by the depositor’s bank (it was). Non-local checks can be held for five business days, but not a day longer.

As if she were doing me a favor, the BofA social media agent proudly announced she would release my funds to me, even though BofA sent me a notice that it intended to delay the deposit as long as eightbusiness days — again, in violation of federal regulations according to BankRate.com.

Of course, I have neither the time nor the money to sue Bank of America. But I do have my blog and the bully pulpit of Wise Choices…and I will soon be taking my banking elsewhere.

Just so you know, here’s BankRate.com’s summary of federal regulations regarding the availability of deposited funds:

- Banks must post or provide a notice at each ATM location that funds deposited in the ATM may not be available for immediate withdrawal.

- If a bank makes funds from deposits at an ATM it doesn’t own available for withdrawal later than funds from deposits at an ATM it does own, it must provide a description of how the customer can tell the difference between the two ATMs.

- If you deposit money in an ATM that isn’t owned by your bank, the funds must be available for withdrawal not later than the fifth business day following the banking day on which the funds are deposited.

- Funds deposited at an ATM that is not on or within 50 feet of the premises of the bank are considered deposited on the day funds are removed from the ATM, if funds are not normally removed from the ATM more than two times each week.

- A bank that operates an off-premises ATM from which deposits are not removed more than two times each week must disclose at or on the ATM the days on which deposits made at the ATM will be considered received.

- Funds deposited at a staffed facility, ATM or contractual branch are considered deposited when they are received at the staffed facility, ATM or contractual branch.

Copyright 2018 Wise Choices TM. All rights reserved.

Stimulus Check Mobile Deposit Bank Of America

Point. Click. Deposit. See how easy it is to deposit a check using the MyMerrill Mobile app!

MyMerrill Mobile Check Deposit

Mobile Check Deposit on the MyMerrill mobile app allows you to securely and conveniently deposit checks anytime and anywhere into eligible Merrill investment accounts.

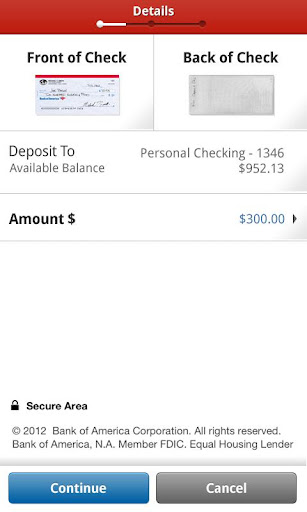

Once you log into the MyMerrill mobile app:

- Tap on the check deposit icon.

- Using your device’s camera, take a picture of both

sides of the check. - And remember to sign the back.

- Select your deposit to account & enter the

amount. - Tap continue to verify the deposit, and lastly

finally, tap “make deposit” to process therequest.

A confirmation notice will appear on the screen letting you know it the check was accepted.

- You may can check the status of your deposit at

any time by returning to the app,selecting “check deposit” and then “view status.” - Deposits made after 7:30 p.m. Eastern Time will

be processed on the next business day. - It may take up to eight days before you can invest

or withdraw the funds. - The check should be kept for 14 days to ensure

the issuer has honored the payment.

Mobile check deposit provides you a secure and convenient option right from your home!

Important Information:

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (BofA Corp.). MLPF&S is a registered broker-dealer, Member SIPC and a wholly owned subsidiary of BofA Corp.

Investment products:

- Are Not FDIC Insured

- Are Not Bank Guaranteed

- May Lose Value

Mobile Check Deposit Hold Bank Of America

Nothing discussed or suggested in these materials should be construed as permission to supersede or circumvent any Bank of America, Merrill Lynch, Pierce, Fenner & Smith Incorporated policies, procedures, rules, and guidelines.

Neither Merrill Lynch nor any of its affiliates or financial advisors provide legal, tax or accounting advice. Clients should be instructed to consult with their legal and/or tax advisors before making any financial decisions.

How To Make A Mobile Deposit

© 2020 Bank of America Corporation. All rights reserved.