Chime Mobile Check Deposit Time

- Chime Mobile Check Deposit Time Reddit

- Chime Mobile Check Deposit Time Clock

- Chime Mobile Check Deposit Saturday

- Chime Mobile Check Deposit Hold Time

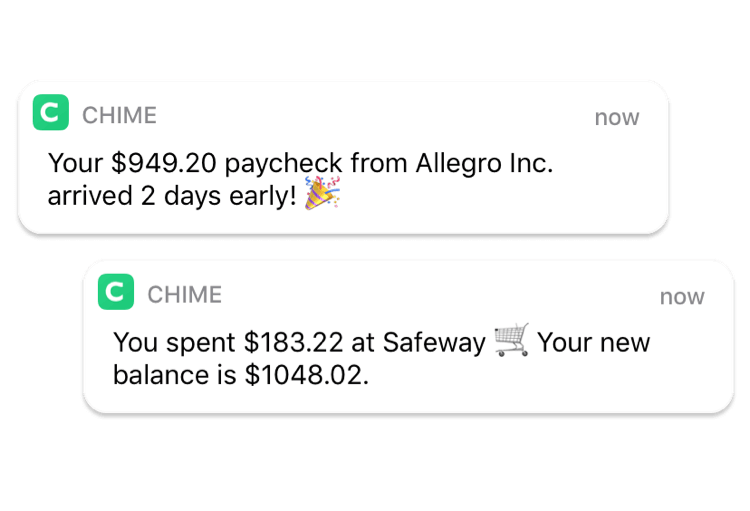

18 minutes ago Chime direct deposit late. Chime for me has consistently posted shortly right after 10 PM on Wednesdays, albeit tonight posted around 10:57. Chime members with total monthly qualifying direct deposits of 0 or more are eligible to enroll. PayPal is always slower than chime but generally sometime after midnight it shows up. How does Chime’s mobile check deposit work? The Chime application is available for Android and iPhone smartphone users. Once you have installed the app on your phone, you can deposit checks from any part of the world. Limits, Time & Cancel. Deposit Personal Check to Prepaid Card.

Your federal tax refund is important, and we want you to have it as fast as possible. That's why you can get your tax refund up to 3 days early1 when you direct deposit with Chime and file directly with the IRS.

in government payments have been processed by Chime to date.

that filed with the IRS have received their government refunds up to 3 days early1 through direct deposit with Chime.

Filing your taxes can be complicated.

Getting your federal tax refund early1

with Chime is simple!

The IRS will start processing returns on February 12, 2021. Here’s how to help your federal tax refund arrive as quickly as possible with direct deposit.

You may receive forms from your employer or financial institution.

Add your Chime Spending Account and bank routing number when you file your federal taxes directly with the IRS.

Your federal tax refund will post to your Chime Spending Account as soon as it is received.

New to Chime?

Get your federal tax refund up to 3 days early1, access to Chime’s best features, and financial peace of mind by signing up! The process is fast and easy.

We’re going above and beyond to have your back

We can’t control how the IRS processes taxes, but we’re here to help you figure it out and get your refund as fast as possible. Check out our resources on this page for more.

FAQs

If you have questions regarding taxes and your Chime account, please check out our FAQs below

Chime & Taxes

Nope! You do not have to pay or declare taxes for using Credit Builder. To learn more about filing taxes, we recommend speaking with a tax professional and checking theIRS website.

Will I have to pay taxes on SpotMe? Stimulus advances?

Nope! You do not have to pay or declare taxes for using SpotMe or any of the SpotMe Stimulus Payment advances. To learn more about filing taxes, we recommend speaking with a tax professional and checking theIRS website.

I just got my refund! What are my spending/withdrawal limits?

Chime Mobile Check Deposit Time Reddit

You can find your current Chime Spending Account and withdrawal limits by using the chat feature in your Chime mobile app, or by going to Settings > Account Policies & Terms > Deposit Account Agreement in order to view your current account limits.

Can I still get my refund if my transactions are turned off?

Yes! Disabling transactions only works for Chime Visa® Debit Card transactions and does not affect tax refunds³ or direct deposits.

Can I deposit my refund check with Mobile Check Deposit?

Sometimes. Unfortunately, we cannot currently guarantee that our Mobile Check Deposit feature will accept all tax refund checks³ due to their unique shape, color, and markings.

Learn more about Mobile Check Deposit limits in your Deposit Account Agreementhere. Please view the back of your debit card to identify your issuing bank.

How do I deposit my tax refund to my Chime account?

Direct deposit is the easiest way to deposit your tax refund into your Chime Spending Account. Whether you file online or on paper, all you need to do is enter your Chime Spending Account Number and Routing Number where prompted.

You can find your Spending Account Number and Routing Number in the Chime app! Just go to Settings > Account Information!

Will I get my tax refund up to two (2) days early?

We can’t guarantee that your tax refund will deposit earlier than the estimated date provided by the IRS. That said, we’ll always post your tax refund to your account as soon as we receive it!

Yes, however a tax refund may only be direct deposited into an account that is in your name. To accept a joint refund, just make sure the name of the primary filer listed on your tax refund is the exact same name listed on the Chime Spending Account you are depositing to.

Important: If the primary filers name doesn’t match the name on the Chime Spending Account it is being deposited, the deposit will be rejected and returned to the IRS. No more than three electronic refunds can be deposited into a single financial account or prepaid card. If you exceed this limit, you will receive a notice from the IRS and a paper check refund.

If you recently got married or changed your name, contact Chime Member Services to update the name on your Chime Spending Account to match the name on your tax return. You’ll need your updated ID and marriage certificate for verification.

We’ll always post your tax refund to your account as soon as we receive it. If you don’t see your tax refund yet, that means we haven’t received it, and our Member Services team won’t have any further information about when it will become available.

The best way to find your estimated refund date is to visit Where’s My Refund on the IRS.gov website or the IRS2Go mobile app. If your expected refund date has passed, we recommend contacting the IRS for more information.

Note: State and Federal Tax Returns are processed on different timelines, and may post to your account on different days.

Can you increase my spending and withdrawal limits?

No. Our spending and withdrawal limits are controlled by our holding bank and cannot be changed at this time.

If I lost my card, will I still get my tax refund?

Yes! Your tax return is deposited using your Chime Spending Account number and Routing number. These do not change when you order a new card.

To make purchases larger than your daily spending limit on your Chime Visa® Debit Card, you can set up direct debit payments with billers who offer this option. You’ll just need to provide the merchant with your Spending Account Number and Routing Number.

Direct debits will be removed from your Chime Spending Account when requested by a biller and do not place any hold on your funds. If your balance is not sufficient to cover the payment, it will be declined.

Note: There are no limits or fees associated with direct debits.

Tax Basics

What if I owe money on my taxes this year due to Unemployment?

It’s possible your tax implications may have changed due to COVID and Unemployment. We recommend speaking with a tax professional and checking theIRS website for more information.

Chime Mobile Check Deposit Time Clock

Will I have to pay taxes on the Stimulus Payments?

The IRS has statedthat the Economic Impact Payment (aka Stimulus Payment) will not reduce your refund or increase the amount you owe when you file your 2020 Federal income tax return. For the most updated Tax information, please check theIRS website.

What if I still haven’t received my Economic Impact Payment?

If you did not receive a Stimulus Payment for which you are eligible, you may be eligible for the Recovery Rebate Credit. Please check theIRS website for more information.

What if I need to file for a tax deadline extension?

According to the IRS, if you need more time to prepare and file your taxes, you may be able to file for an extension before the April 15th deadline. We recommend speaking with a tax professional and checking theIRS website for more information.

Alternative: Need more time to prepare your federal tax return? Please check this IRSwebsite which provides information on how to apply for an extension of time to file.

The last day to file your taxes without a penalty is Thursday, April 15th, 2021. To learn more about filing taxes, we recommend speaking with a tax professional and checking theIRS website.

Why should I select direct deposit as my refund method?

Eight out of ten taxpayers get their refunds by using Direct Deposit. It is simple, safe and secure. This is the same electronic transfer system used to deposit nearly 98 percent of all Social Security and Veterans Affairs benefits into millions of accounts.

According to the Internal Revenue Service (IRS), “Combining direct deposit with IRS e-File is the fastest way to receive your refund. IRS issues more than9 out of 10 refunds in less than 21 days. You can track your refund using the IRS’s ‘Where’s My Refund‘* tool.” To find out more, readthis article updated on December 4, 2020.

We will notify you as soon as we have received your refund – with an email and a push notification (if enabled on your mobile device)!

What happens if I made a mistake while filing my taxes?

If your tax refund has not yet been sent, you can call the IRS to stop it. Their toll-free number is 1-800-829-1040.

My refund is less than it should be. What should I do?

If your tax refund is less than you were expecting, we recommend contacting the IRS. If you have the Save When I Get Paid feature enabled, 10% of your tax refund will be deposited automatically into your Chime Savings Account.

Your tax refund may be returned if:

- You filed your tax refund under a different name than the one you have on your Chime Spending Account.

- You attempted to deposit someone else’s tax refund into your Chime Account.

- You accidentally used the wrong account number or routing number when you filed.

The most common reason that tax refunds and direct deposits are returned is because the name on the direct deposit doesnotmatch the name on the Chime Account.

If you recently got married or changed your name, contact Chime Member Services to update the name on your Chime Spending Account to match the name on your tax return. You’ll need your updated ID and marriage certificate for verification.

If the name on the direct deposit does not match the name on the Chime Account, the deposit will be returned to the IRS.

If my tax refund was returned, how do I get it now?

Any tax refund that is returned to the IRS will be sent out as a physical check to the address you listed when you filed your taxes. Please reach out to the IRS directly if your refund was returned.

Mobile banking the way it should be

An award-winning mobile bank account with no hidden bank fees that gets you paid up to 2 days early with direct deposit.¹

Learn how we collect and use your information by visiting our Privacy Policy›

The Bancorp Bank or Stride Bank, N.A.; Members FDIC

Chime is an award-winning mobile bank account and debit card

- No hidden bank fees.

- Get paid up to 2 days early with direct deposit.¹

- Grow your savings, automatically.

- Applying for a bank account and debit card is free.

Finally, a banking app built by a tech company

With over 135,000+ five star reviews in app stores, Chime makes mobile banking easy with a modern and intuitive banking app that handles everything from tracking your spending and savings to paying friends. It works on all smartphone mobile devices, whether you’re on an iPhone® or an Android™ device. Transfer money, send and deposit checks, pay bills and even grow your savings automatically without ever worrying about hidden banking fees again.

Always know your account balance

Stay on top of your money. Our banking app sends you daily bank account balance notifications and instant transaction alerts anytime you use your debit card. No need to log in just to check your balance with Chime. App notifications make sure you always know where you stand so you can make better informed decisions with your money.

Banking security done right

Security made fast and simple. Finally, you can take control of your banking security and we offer everything you need to make it easy.

Block Debit Card Transactions

Instantly disable your card with one swipe in our mobile app. Whether you lost your debit card or had some suspicious charges, we put you in control. Our security measures include one-touch transaction blocking and the ability to shut off international transactions on the card.

Instant Transaction Alerts

Instant transaction alerts let you know any time your debit card has been used.

Deposit checks on the go with mobile check deposit

Need to deposit a check? Just snap a quick photo with our mobile banking app and watch your account balance grow. No more deposit slips, waiting in line, or sending checks via mail. Mobile check deposit allows you to deposit checks from anywhere.

Send money instantly online to your friends and family

Send money instantly to friends using our mobile banking app. Our Pay Friends feature allows you to send fee-free mobile payments to friends or family when they open an account with Chime. No transaction fees or monthly fees for sending payments. Great for splitting rent or divvying up the bar tab. Start sending money instantly and with ease.

Free ATMs withdrawals at over 38,000+ fee-free ATMs

Use our mobile app to locate an in-network free ATM and use your Chime debit card to make a withdrawal without the fees. Withdrawals can be made at any of our 38,000+ fee-free MoneyPass® and Visa® Plus Alliance ATMs or 30,000+ cash-back locations.

Transfer money with convenience

With Chime’s mobile app, money transfers just got a whole lot easier. Easily transfer your money between your Spending Account and Savings Account when you need it with just a few taps. The app allows you to connect your external bank account, credit cards, and investment accounts so you can stay on top of all of your account balances and easily transfer money into your Chime account.

We love mobile payment apps

Chime supports mobile payment apps including Apple Pay™, Google Pay™, and Samsung Pay. Combining Chime with mobile pay means you can leave your wallet at home. Just buy what you want and know exactly how much you have–anywhere.

We put your checks in the mail for you

The Chime mobile app lets you send checks via mail. You can send checks to businesses and individuals. Just let us know who to send it to, how much, and we’ll make sure your check gets to where it needs to be. Think of us as your personal assistant and let us do the mailing for you.

Chime Mobile Check Deposit Saturday

You can have all of these banking features with no hidden fees and a modern, award-winning mobile banking app. Signing up takes less than 2 minutes. No minimum balance is required to open an account and it does not impact your credit score. So, what are you waiting for?

2 minutes with no impact to your credit score.

Chime Mobile Check Deposit Hold Time

Learn how we collect and use your information by visiting our Privacy Policy›