Bdo Savings Account Interest Rate

[Last updated 20 May 2020] Compare these high-interest savings accounts (peso-savings) for 2020 offered by the 10 largest banks in the Philippines to find the best one where you could deposit your hard-earned money. Consider high interest rates, initial deposits, maintaining balance, and amount to earn interest.

- Bdo Atm Savings Account Requirements

- Bdo Savings Account Interest Rates

- Savings Interest Rates Today

- Bdo Savings Account Interest Rates

It only means that the interest rates are a bit higher than the the interest rate for regular savings accounts, which is usually 0.25%. Here are higher-interest savings accounts offered by 2 of the top 3 banks in the Philippines: BDO. BDO Optimum Savings Account. The BDO Peso Passbook Savings Account lets you enjoy the benefits of a typical interest-earning account with the security of a passbook. It encourages you to develop a good savings habit. When you open an account, you are given the option to choose if you want a BDO EMV Debit Card for convenience in accessing ATMs or have the passbook alone.

Balak mo bang mag-open ng Deposit o Savings account sa BDO at hindi mo alam papano at saan maguumpisa?Panuorin ang buong video tutorial para ika'y matulungan.

As I have clarified in one of my articles, maintaining savings accounts and other deposits remains far better than simply keeping a stash of cash under the mattress. Yes, many argue that these are not real investments because we allow our money to sleep in the vault (well, we know what banks do with our money) with a very low interest. However, financial gurus advise that we save and build our emergency funds – in high-interest savings accounts.

Here is a list of peso-savings accounts (2020) offered by the 10 largest banks. Annual interest rates, as indicated, range from 0.10 to 1.25 percent (usually tiered-rate accounts). To know more about interest computations, click this link: Gabay sa Pagbubukas ng Savings Account.

[1] Bank of the Philippine Islands (BPI)

- Advance Savings

- PHP100,000 (min initial deposit)

- PHP100,000 (min MADB requirement)

- PHP100,000 (min balance to earn interest)

- 0.75-1.125% (annual interest)

- Maxi Saver (High Returns)

- PHP50,000 (min initial deposit)

- PHP50,000 (min MADB requirement)

- PHP50,000 (min balance to earn interest)

- 0.25-0.625% (annual interest)

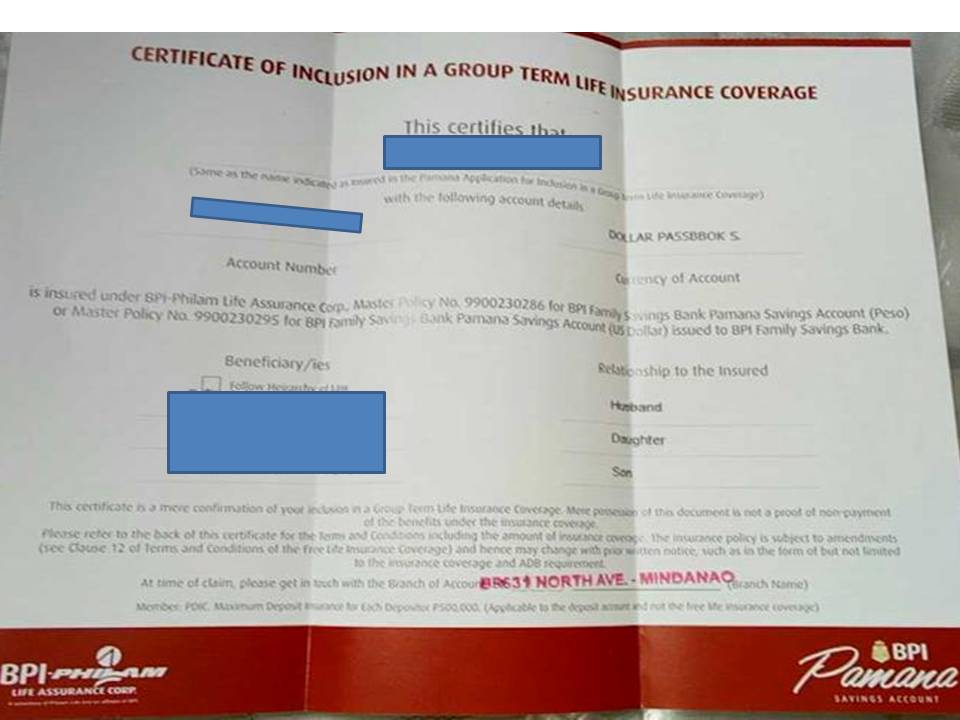

- Pamana Savings (with 3X Life Insurance)

- PHP25,000 (min initial deposit)

- PHP25,000 (min MADB requirement)

- PHP25,000 (min balance to earn interest)

- 0.25% (annual interest)

source: BPI website (data as of 20 May 2020). Visit their official website or the nearest servicing branches to check for possible updates on high-interest savings accounts and current rates.

[2] Security Bank Corporation (Security Bank)

- eSecure Savings

- PHP500 (min initial deposit)

- PHP500 (min MADB requirement)

- PHP5,000 (min balance to earn interest)

- 0.50-1.20% (annual interest)

- Build Up Savings

- PHP5,000/50,000 (min initial deposit)

- PHP5,000/50,000 (min MADB requirement)

- PHP10,000/50,000 (min balance to earn interest)

- 50/1.00% (annual interest)

- Money Builder

- PHP10,000 (min initial deposit)

- PHP10,000 (min MADB requirement)

- PHP10,000 (min balance to earn interest)

- 0.10-0.40% (annual interest)

source: Security Bank website (data as of 20 May 2020). Visit their official website or the nearest servicing branches to check for possible updates on high-interest savings accounts and current rates.

Bdo Atm Savings Account Requirements

[3] BDO Unibank, Inc. (BDO)

- Optimum Savings

- PHP30,000 (min initial deposit)

- PHP30,000 (min MADB requirement)

- PHP30,000 (min balance to earn interest)

- NO DATA (annual interest)

- Passbook Savings

- PHP5,000 (min initial deposit)

- PHP10,000 (min MADB requirement)

- PHP10,000 (min balance to earn interest)

- 0.25% (annual interest)

- ATM Savings

- PHP2,000 (min initial deposit)

- PHP2,000 (min MADB requirement)

- PHP5,000 (min balance to earn interest)

- 0.25% (annual interest)

- Junior Savers

- PHP100 (min initial deposit)

- PHP100 (min MADB requirement)

- PHP2,000 (min balance to earn interest)

- 0.25% (annual interest)

source: BDO Unibank website (data as of 20 May 2020). Visit their official website or the nearest servicing branches to check for possible updates on high-interest savings accounts and current rates.

[4] Metropolitan Bank and Trust Company (Metrobank)

- Regular Passbook Savings

- PHP10,000 (min initial deposit)

- PHP10,000 (min MADB requirement)

- PHP10,000 (min balance to earn interest)

- 0.25% (annual interest)

- Regular Debit/ATM Savings

- PHP2,000 (min initial deposit)

- PHP2,000 (min MADB requirement)

- PHP10,000 (min balance to earn interest)

- 0.25% (annual interest)

source: Metrobank website (data as of 20 May 2020). Visit their official website or the nearest servicing branches to check for possible updates on high-interest savings accounts and current rates.

[5] Rizal Commercial Banking Corporation (RCBC)

- Dragon Peso Savings (Premium)

- PHP25,000 (min initial deposit)

- PHP25,000 (min MADB requirement)

- PHP25,000 (min balance to earn interest)

- 0.15-0.5625% (annual interest)

- iSave

- NONE (min initial deposit)

- NONE (min MADB requirement)

- PHP5,000 (min balance to earn interest)

- 0.15-0.20% (annual interest)

source: RCBC website (data as of 20 May 2020). Visit their official website or the nearest servicing branches to check for possible updates on high-interest savings accounts and current rates.

Bdo Savings Account Interest Rates

[6] China Banking Corporation (Chinabank)

- Money Plus Savings

- PHP20,000 (min initial deposit)

- PHP20,000 (min MADB requirement)

- PHP50,000 (min balance to earn interest)

- 0.125% (annual interest)

- ChinaCheck Plus

- PHP5,000 (min initial deposit)

- PHP5,000 (min MADB requirement)

- PHP50,000 (min balance to earn interest)

- 0.125% (annual interest)

- Passbook Savings

- PHP5,000 (min initial deposit)

- PHP5,000 (min MADB requirement)

- PHP10,000 (min balance to earn interest)

- 0.125% (annual interest)

source: Chinabank website (data as of 20 May 2020). Visit their official website or the nearest servicing branches to check for possible updates on high-interest savings accounts and current rates.

[7] Philippine National Bank (PNB)

- Passbook Savings

- PHP10,000 (min initial deposit)

- PHP10,000 (min MADB requirement)

- PHP15,000 (min balance to earn interest)

- 0.10% (annual interest)

- Debit Savings Account

- PHP3,000 (min initial deposit)

- PHP3,000 (min MADB requirement)

- PHP10,000 (min balance to earn interest)

- 0.10% (annual interest)

source: PNB website (data as of 20 May 2020). Visit their official website or the nearest servicing branches to check for possible updates on high-interest savings accounts and current rates.

[8] Union Bank of the Philippines (Unionbank)

- Regular Savings Account

- PHP10,000 (min initial deposit)

- PHP10,000 (min MADB requirement)

- PHP25,000 (min balance to earn interest)

- 0.10% (annual interest)

- Personal Savings Account

- NONE (min initial deposit)

- NONE (min MADB requirement)

- PHP10,000 (min balance to earn interest)

- 0.10% (annual interest)

Source: Unionbank official website (data as of 20 May 2020). Visit their official website or the nearest servicing branches to check for possible updates on high-interest savings accounts and current rates.

[9] Land Bank of the Philippines (Landbank)

- Easy Savings Plus (ESP)

- PHP20,000 (min initial deposit)

- PHP20,000 (min MADB requirement)

- PHP20,000 (min balance to earn interest)

- NO DATA (annual interest)

- Regular Passbook Savings

- PHP10,000 (min initial deposit)

- PHP10,000 (min MADB requirement)

- PHP10,000 (min balance to earn interest)

- 0.10% (annual interest)

source: Landbank website (data as of 20 May 2020). Visit their official website or the nearest servicing branches to check for possible updates on high-interest savings accounts and current rates.

[10] Development Bank of the Philippines (DBP)

- ATM or Passbook

- PHP500 (min initial deposit)

- PHP500 (min MADB requirement)

- PHP500 (min balance to earn interest)

- NO DATA (annual interest)

- Wisdom Account

- PHP5,000 (min initial deposit)

- PHP5,000 (min MADB requirement)

- PHP5,000 (min balance to earn interest)

- NO DATA (annual interest)

Savings Interest Rates Today

source: DBP website (data as of 20 May 2020). Visit their official website or the nearest servicing branches to check for possible updates on high-interest savings accounts and current rates.

Bdo Savings Account Interest Rates

Disclaimer: The author is not directly affiliated with any of these 10 largest banks in the Philippines, however maintains peso-savings accounts with some of them. Please take this article providing helpful information about high-interest savings accounts as a personal guide upon opening a savings account; hence, visiting the official websites and servicing branches of these banks is highly advised.